Calculate depreciation of furniture

Because the federal government seeks to incentivize businesses using solar technology it offers a desirable depreciation schedule. The new rules allow for 100 bonus expensing of assets that are new or used.

Depreciation Of Furniture And Fixtures Download Scientific Diagram

You just take the assets purchase price and deduct its.

. The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. For book purposes most businesses depreciate assets using the straight-line method. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë ÉºÊÄ8ÌiB2mÕóLù-8Ûàu ÎY ÅV1ZÔÅÀwØ _fe pwõOÆqfšŠEww Á_.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. To calculate depreciation subtract the assets salvage value from its cost to determine the amount that can be depreciated. While expense depreciation can take a few different forms special rules apply to solar panels.

The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20. Tangible physical assets depreciate while you expense intangible assets using amortization. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method.

How to Calculate Depreciation. Useful life 5. Section 179 deduction dollar limits.

A patent for example is an intangible asset that a business can use to generate revenue. Lets calculate the depreciation. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

You can now calculate depreciation for each year of the life of your asset by taking the depreciable basis times the rate from the table. After filling out the order form you fill in the sign up details. Straight line depreciation percent 15 02 or 20 per year.

IRS calls this type of property like vehicles machinery equipment and furniture capital assets. Here we learn how to calculate earnings before interest tax depreciation and amortization using its formula along with examples. Appendix A includes three different tables used to calculate a MACRS depreciation deduction.

This is an accelerated depreciation method that expenses more depreciation at the beginning of the life of an asset than at the beginning. The salvage value is 200. As mentioned assets like office furniture depreciate at varying rates.

It is shown as a business expense in the PL statement which reduces the taxable income and therefore decreases the tax liability for the businesses. If you purchase a 15-inch laptop for 1500 and submit a request for recoverable depreciation you will be reimbursed 400 the recoverable depreciation on your original laptop. Amortization and depreciation are both used to calculate the value of assets over a period.

Look at your pay stub from your employer under gross amount This is before any other deductions are taken out. To calculate EBITDA youll want verifiable information regarding your companys earnings tax and interest expenses and depreciation and amortization expenses. Calculating depreciation on furniture is the same as calculating depreciation on any other asset like machinery or vehicle.

Depreciation enables companies to generate revenue from their assets while. For example double-declining depreciation for asset with a 10-year life would be 2 x 10. Divide this amount by the number of years in the assets useful lifespan.

An example of fixed assets are buildings furniture office equipment machinery etc. First you calculate the depreciation of that asset for the first year it is in service. Using this example in year 4 the depreciable cost is 216.

Now that EBIT has taken out the depreciation and amortization expense in the income statement it is required to add back the expense to assess the companys cash flow. Accumulated depreciation is the total value of the asset that is expensed. Accounting for the loss of value of the assets helps companies.

Lets say you purchased a piece of computer equipment for your business at a cost of 8000. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. In year 5 there is no need to calculate depreciation.

This rate is found by multiplying the straight line percentage of depreciation. Ensure you request for assistant if you cant find the section. A companys capital assets may include.

If you find that you cannot repair or replace damaged or destroyed items for the replacement cost established on your estimate please contact your Claim. In year 4 calculate depreciation of 16 to reduce the final value to 200. Penny is an American furniture.

For instance solar system depreciation falls under a five-year plan for companies. The depreciation table is shown below. Calculate wages earned.

The average computer lasts. Usually earnings tax and interest figures are included on a companys income statement while depreciation and amortization figures are found in the notes to a companys profit and. The second chart the Percentage Table Guide asks for the convention month or quarter that you placed the Toyota in service.

Office furniture and fixtures farm equipment any assets that dont fit into other classes. These assets had to be purchased new not used. Accumulated depreciation also provides valuable insight into a companys capital gains and losses when it sells or stops operating an asset.

Rather than try to learn all the intricate details its a good idea to let your tax. Boats single-purpose farm structures. The only difference is the depreciation rate of the asset and the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be put to use for the companys.

This is the easiest and most simple way to calculate depreciation. The number of years that you can include the depreciation of furniture is all based on your companys policy but typically most companies use only 3 years. Its value indicates how much of an assets worth has been utilized.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct. Depreciation rate 20 2 40 per year.

Buildings but not the real estate itself When a company purchases an asset management must decide how to calculate its depreciation. Do the same for your spouses wages and add it to your amount if you are married and plan to file jointly. Buildings machinery furniture and fixtures wear out computers and technology devices become obsolete and they are expensed as their value approaches zero.

Office furniture and fixtures horses not three-year property and other property not designated a recovery periodincluding machinery not listed as five-year property. Stop accumulating depreciation in any year in which the depreciable cost falls below the salvage value. Use declining balance depreciation.

This is why there are several ways to calculate depreciation. The most widely used method of depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. And furniture to the years the business will use the assets.

The accumulated depreciation of an asset is also necessary to determine the taxable gain on the sale of an asset. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. Here are some of them.

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Employee Handbook

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Templates

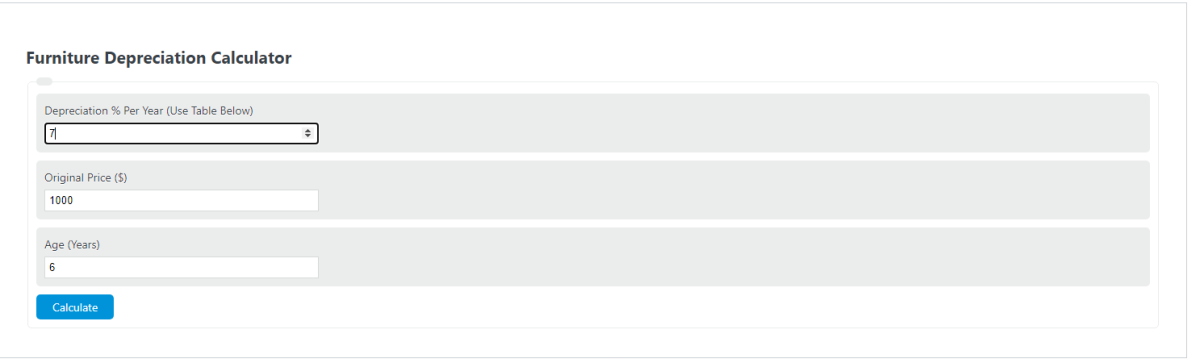

Furniture Depreciation Calculator Calculator Academy

Depreciation Formula Calculate Depreciation Expense

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

Depreciation Nonprofit Accounting Basics

![]()

Furniture Calculator Splitwise

Accumulated Depreciation Explained Bench Accounting

Furniture Depreciation Calculator Calculator Academy

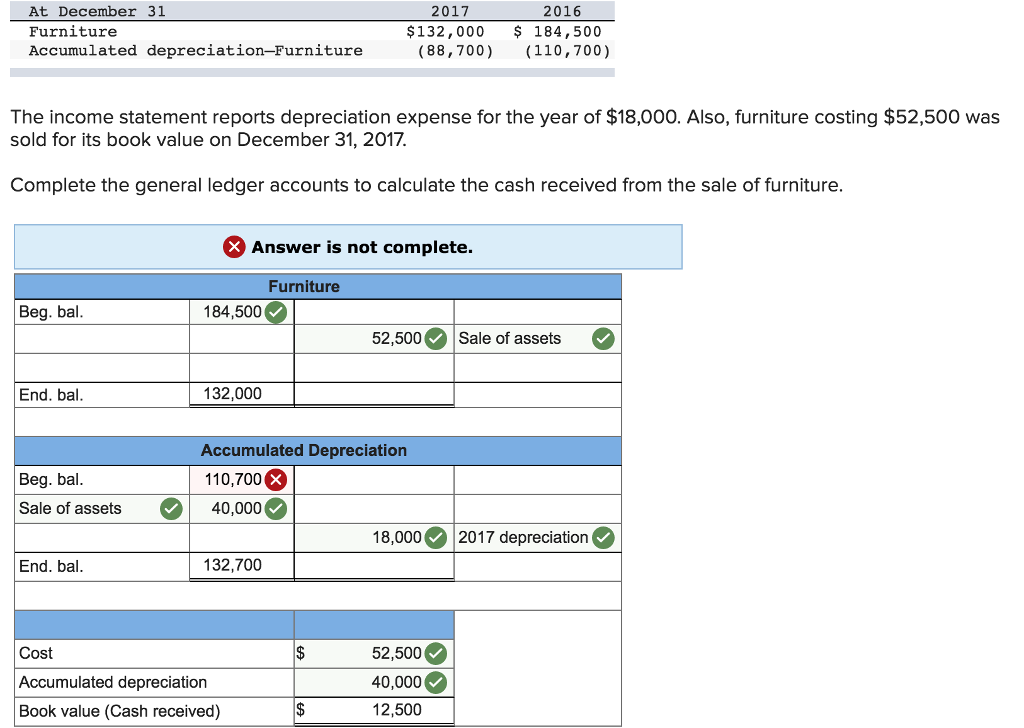

Solved At December 31 Furniture Accumulated Chegg Com

Depreciation Nonprofit Accounting Basics

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

How To Calculate Depreciation Expense For Business

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting